Gold rose as the drop to this year’s low lured Chinese buyers returning from a weeklong break, while investors awaited minutes of the Federal Reserve’s last meeting. Platinum extended a rally from a five-year low.

Gold rose as the drop to this year’s low lured Chinese buyers returning from a weeklong break, while investors awaited minutes of the Federal Reserve’s last meeting. Platinum extended a rally from a five-year low.

Bullion for immediate delivery climbed as much as 0.5 percent to $1,214.85 an ounce, and traded at $1,213.75 by 2:17 p.m. in Singapore, according to Bloomberg generic pricing. The metal dropped on Oct. 6 to $1,183.24, the lowest since Dec. 31. Platinum advanced for a third day as Russia and South Africa prepared to meet to discuss ways to buoy prices.

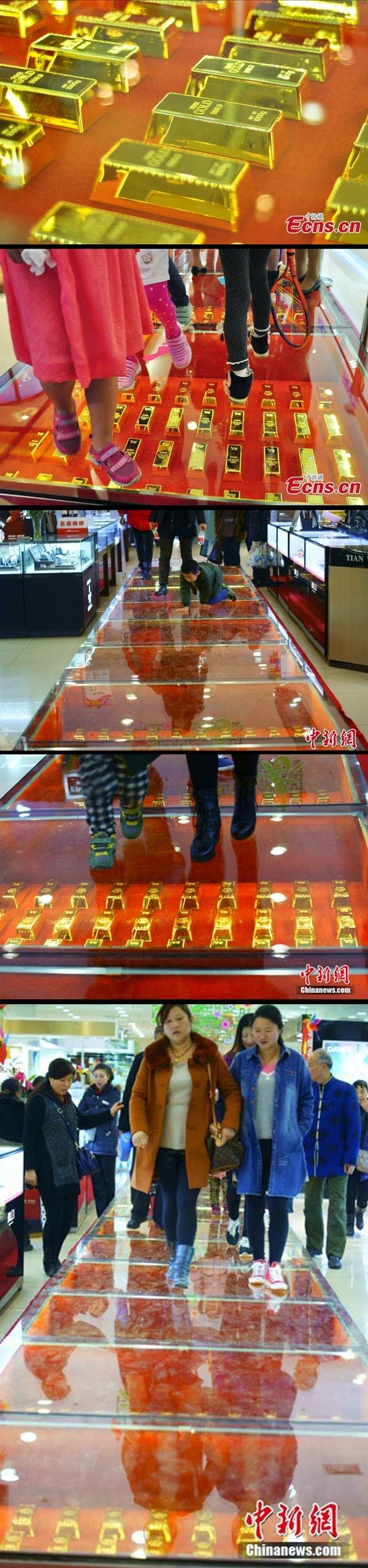

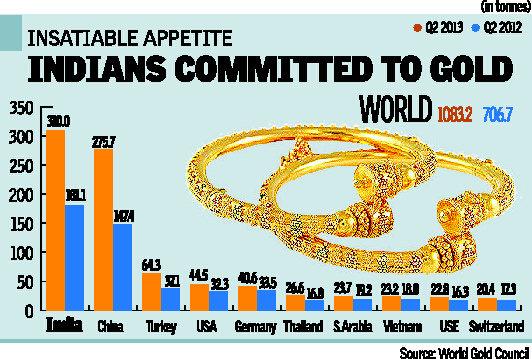

Gold is being supported as markets in China opened after being shut from Oct. 1-7, according to Victor Thianpiriya, an analyst at Australia & New Zealand Banking Group Ltd. Demand in India is set to pick up before the Diwali festival on Oct. 23, according to Mark Keenan, head of Asia commodities research at Societe Generale SA. China overtook India as the largest consumer last year.

“India and China’s robust growth in consumer demand will only benefit physical gold demand,” Joel Crane, an analyst at Morgan Stanley, wrote in a report today. In the near term, a stronger dollar and rising real U.S. interest rates will generate “considerable headwinds” for gold and other precious metals, he said.

The Bloomberg Dollar Spot Index added 0.3 percent before the Fed releases minutes of its Sept. 16-17 meeting, when monthly bond-buying was cut a seventh time and policy makers kept a pledge to hold rates near zero for a “considerable time.” Gold also rose as the MSCI All-Country World Index headed for the lowest close since April after the International Monetary Fund cut its 2015 outlook for global growth.

Terendah dalam masa 5 tahun

A third day of gains today would be the longest rally in more than a month. Bullion for December delivery traded at $1,214 an ounce on the Comex in New York from $1,212.40 yesterday, when futures climbed for a second day. Holdings in the SPDR Gold Trust, the biggest gold-backed exchange-traded product, were unchanged for a third day yesterday at 767.47 metric tons, the least since December 2008.

Platinum for immediate delivery rose 0.4 percent to $1,263.63 an ounce after tumbling on Oct. 6 to $1,190.25, the lowest level since 2009. Palladium traded at $787.15 an ounce from $785.79 yesterday, when prices completed a two-day, 4 percent advance.

Russia and South Africa, together holding about 80 percent of the earth’s platinum-group metal reserves, are set to meet to discuss ways to buoy prices. Officials from Russia’s central bank and OAO GMK Norilsk Nickel, the biggest producer of palladium, will attend the meeting next month, said Natural Resources Minister Sergei Donskoi. One option is for the central banks to boost buying of platinum and palladium, he said.

“A concerted effort by the two largest PGM producers might be enough to arrest the decline,” ANZ’s Thianpiriya said by e-mail today. Spot silver rose 0.4 percent to $17.2503 an ounce.