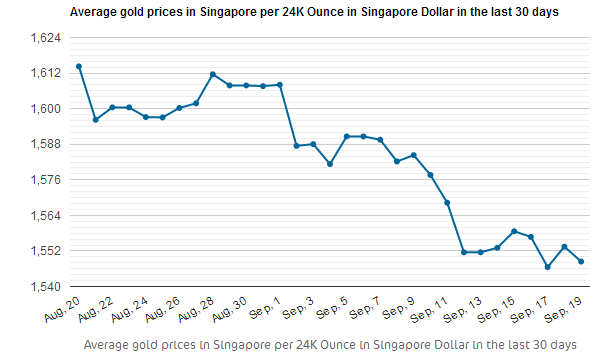

Gold held near an eight-month low as the outlook for higher US borrowing costs strengthened the dollar, damping demand for a store of value. Silver sank to a four-year low and platinum dropped to the lowest this year.

KIRA VALUE EMAS KALKULATOR EMAS, AR-RAHNU, PAJAK GADAI

Kira DisiniGold for immediate delivery traded at US$1,217.91 (RM3,938.7) an ounce at 8:31am in Singapore from US$1,215.70 on Sept 19, when the metal fell to US$1,213.87, the lowest price since Jan. 2, according to Bloomberg generic pricing. The 14-day relative strength index held below 30 for an eighth day, signaling to some investors that prices may be poised to rebound.

Bullion is headed for its first quarterly loss this year as the Bloomberg Dollar Spot Index rose to a four-year high and investors cut holdings in the largest bullion-backed exchange- traded product.

SIMPLE GOLD TESTING KIT USING ACID TEST TO CHECK GOLD PURITY

Uji Emas AndaFederal Reserve officials last week raised interest-rate projections for 2015, even as the central bank maintained a pledge to keep rates low for a considerable time.

“Gold has been pressured by the dollar’s strength as the market digests the Fed’s statement,” said Sun Yonggang, a macroeconomic strategist at Everbright Futures Co. in Shanghai. “Gold may get a slight reprieve as it’s now oversold.”

Gold for December delivery traded at US$1,217.60 an ounce on the Comex in New York from US$1,216.60 on Sept 19, when prices dropped to US$1,214.20, the lowest since January.

The net-long position in futures and options fell for a fifth straight week, with speculators boosting short bets to the highest level since June in the week ended Sept 16, US government data show.

Holdings in the SPDR Gold Trust, the biggest gold-backed ETP, sank on Sept 19 to 776.44 metric tons, the least Dec 2008.

Investors withdrew about 553 tons last year as gold slumped 28 per cent, the most in more than three decades.

Silver for immediate delivery fell as much as 0.3 per cent to US$17.7828 an ounce, the lowest level since August 2010.

Spot platinum lost as much as 0.2 per cent to US$1,333.38 an ounce, the lowest price since Dec 26.

Palladium rose 0.6 per cent to US$815.75 an ounce, after prices declined to US$808 on Sept 19, the lowest since June 17